Understanding Debt Service Coverage Ratio (DSCR) Loans: A Key Metric for Lenders and Borrowers

When it comes to securing a loan, especially for businesses or real estate investments, understanding how your ability to repay the loan is assessed can make all the difference. One of the most crucial metrics lenders look at is the Debt Service Coverage Ratio (DSCR). This ratio provides a clear snapshot of a borrower’s ability to meet debt obligations based on their income, making it an essential tool for both lenders and borrowers alike. In this post, we’ll dive into what DSCR loans are, how DSCR is calculated, and why it’s a vital factor in lending decisions.

What is DSCR?

The Debt Service Coverage Ratio (DSCR) is a financial metric used by lenders to measure a borrower’s ability to repay their debt obligations. It compares a borrower’s net operating income (NOI) to their total debt service (i.e., the amount required to pay back both principal and interest on a loan).

In simple terms, DSCR tells lenders whether the borrower is generating enough income to cover the loan payments. A higher DSCR indicates a borrower is in a stronger financial position to meet debt obligations, while a lower DSCR suggests the borrower may be at risk of default.

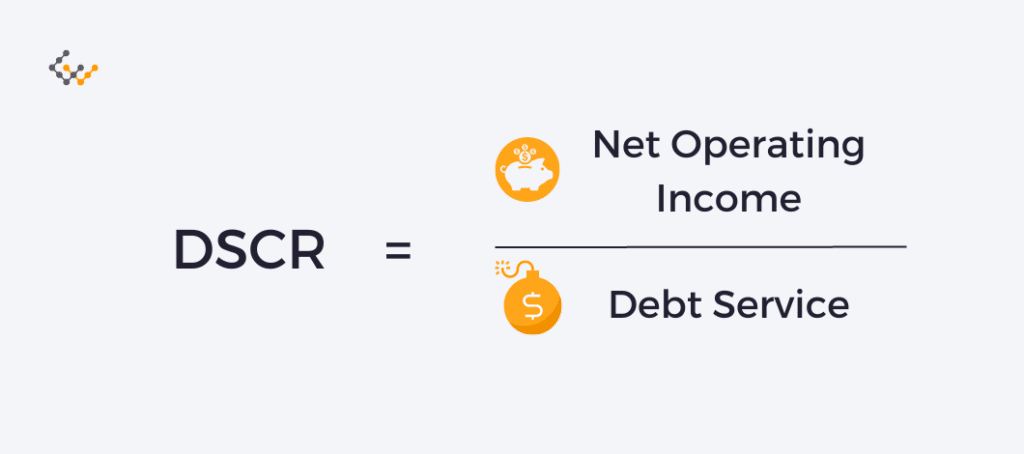

The formula to calculate DSCR is:

Where:

- Net Operating Income (NOI) is the income from operations, typically after expenses but before taxes, depreciation, and interest.

- Total Debt Service is the total annual debt obligations, including both principal and interest payments.

Interpreting DSCR

-

DSCR > 1: A ratio greater than 1 indicates that the borrower generates enough income to cover their debt payments. For example, if the DSCR is 1.2, the borrower generates 20% more income than needed to cover debt service, making them a lower risk for lenders.

-

DSCR = 1: A DSCR of 1 means the borrower’s income exactly matches their debt obligations, suggesting that any changes in their income or expenses could result in difficulty meeting debt payments.

-

DSCR < 1: A ratio below 1 signals that the borrower does not generate enough income to cover their debt obligations. For example, a DSCR of 0.8 means the borrower only earns 80% of what’s needed to cover their debt, increasing the risk of default. In such cases, lenders may consider alternative loan terms, higher interest rates, or reject the loan altogether.

DSCR Loans: How They Work

A DSCR loan is a loan where the approval and terms are based on the borrower’s DSCR. These types of loans are common in commercial real estate financing and business loans, where the income generated by the property or business is the primary source of repayment.

For instance, in a real estate investment, the lender will examine the property’s rental income (NOI) and compare it to the debt service required on the loan. If the DSCR is above the threshold, the borrower is more likely to receive favorable loan terms, such as lower interest rates or higher loan amounts.

Why Lenders Use DSCR in Loan Approvals

Lenders rely on the DSCR as a risk assessment tool. Here’s why it’s so important:

-

Risk Mitigation: DSCR gives lenders insight into how likely a borrower is to default. A higher ratio means the borrower is more likely to repay the loan on time.

-

Simplicity: The DSCR provides a straightforward way to measure financial health. Lenders don’t need to dig through detailed financials to understand repayment capacity—just a quick calculation is sufficient.

-

Cash Flow Focus: Unlike other financial metrics that may focus on overall net worth or asset value, DSCR emphasizes cash flow. This is particularly important for businesses or properties where ongoing income generation is vital for loan repayment.

-

Loan Term Structuring: A higher DSCR might lead to more favorable loan terms (e.g., lower interest rates, longer repayment periods), while a lower DSCR could result in higher interest rates or additional collateral requirements.

How Borrowers Can Improve Their DSCR

For borrowers looking to secure a loan or improve their chances of getting favorable terms, there are several ways to enhance their DSCR:

-

Increase Revenue: Boosting income through higher sales, increased rental rates, or adding new revenue streams can improve NOI and increase the DSCR.

-

Reduce Expenses: Cutting operational costs and increasing efficiency can help to increase net operating income, thereby improving DSCR.

-

Refinance or Restructure Debt: If debt service is too high, borrowers can consider refinancing to lower monthly payments or restructure their debt to reduce financial pressure.

-

Increase Equity Investment: Raising additional capital from investors or other sources can help reduce the loan amount needed, thereby lowering debt service and improving DSCR.

DSCR Loans in Real Estate and Business Financing

-

Real Estate Financing: DSCR loans are common in commercial real estate financing, where the income generated by a property, such as rental income, is the primary source of repayment. In such cases, investors or property owners are often required to maintain a minimum DSCR, which can vary depending on the lender, property type, and loan terms.

-

Business Loans: Businesses that rely on cash flow for loan repayment may also undergo DSCR analysis. Lenders will assess whether the company generates enough income to meet its debt obligations without placing undue strain on its operations.

Conclusion

Debt Service Coverage Ratio (DSCR) loans are an essential part of the lending landscape, offering a clear picture of a borrower’s financial health and repayment ability. For borrowers, understanding the importance of DSCR and working to maintain a healthy ratio can be the key to securing favorable loan terms. For lenders, it’s an invaluable tool to assess risk and ensure that borrowers are capable of fulfilling their debt obligations.

Whether you’re a business owner, real estate investor, or potential borrower, grasping the concept of DSCR loans will give you a competitive edge and ensure you make informed decisions when it comes to financing.