Does Waiting for Lower Interest Rates Make Sense for Renters?If home values rise while you wait for rates to fall, you may not save as much on your payment as you'd think. And you'll spend a lot of money on rent!Consider these examples of initial principal & interest payments on...

Author: Eric

Understanding DSCR Loans

Understanding Debt Service Coverage Ratio (DSCR) Loans: A Key Metric for Lenders and Borrowers When it comes to securing a loan, especially for businesses or real estate investments, understanding how your ability to repay the loan is assessed can make all the difference. One of the most crucial metrics lenders...

Buying a home in a high interest rate environment

In a high-interest rate environment, here are some pieces of advice for people looking to buy a home

All in One Mortgage Loan

What Is an All-In-One Mortgage?An all-in-one mortgage is a mortgage that allows a homeowner to pay down more interest in the short-term while giving them access to the equity built up in the property. It combines the elements of a checking and savings account with a mortgage and home equity line of credit (HELOC)...

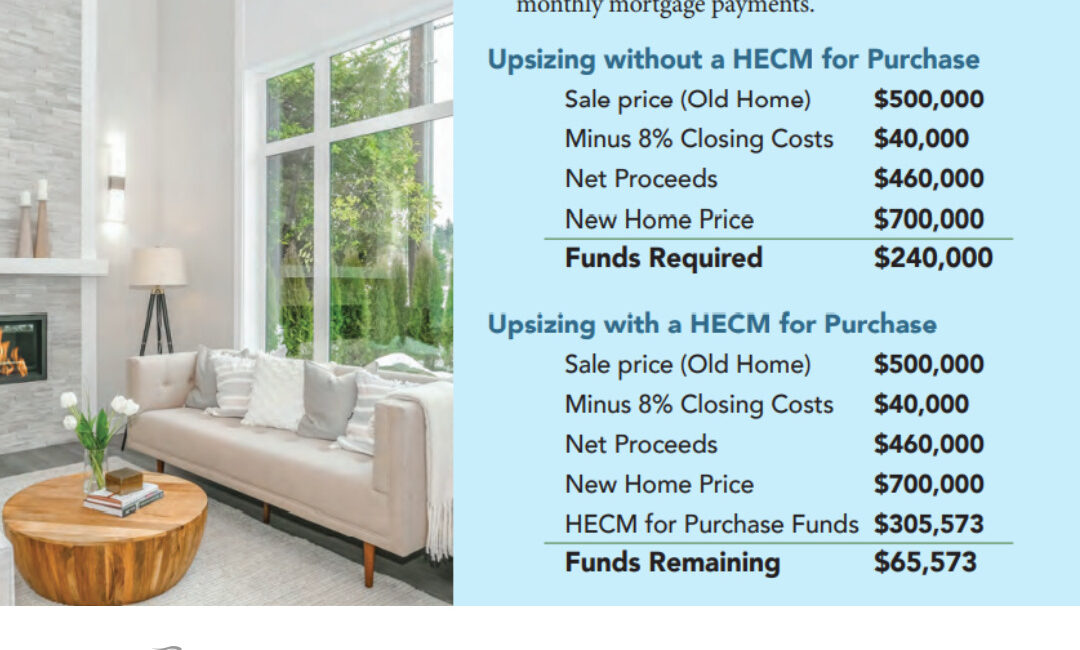

Using a reverse (HECM) mortgage to purchase a home

How to use a reverse (HECM) mortgage to purchase a new home.

Qualify for a mortgage with rent payments

Qualify for a mortgage through a consistent rental history through Fannie Mae's new underwriting guidelines