You can unlock the equity in your home to help finance the purchase of rental property. To do so, you’ll need to take out a home equity line of credit (HELOC) or refinance and take cash out on your home and use the money toward the down payment on the rental property. Under favorable circumstances, the rental property will generate sufficient income to pay all expenses plus provide you enough earnings to make the transaction worthwhile. Right now in a rising rate environment it is better to use a cash out refinance instead of a HELOC to keep your payments consistent.

Figure Your Available Equity

The equity in your home is equal to its current appraised value minus the amount you owe in mortgage debt. A HELOC is a revolving line of credit secured by your home’s available equity. HELOCs are available that will lend you up to 90 percent of the home’s appraised value minus mortgage debt. You can use your HELOC for any purpose, including the purchase of a rental property. The HELOC rate is variable and can rise over time.

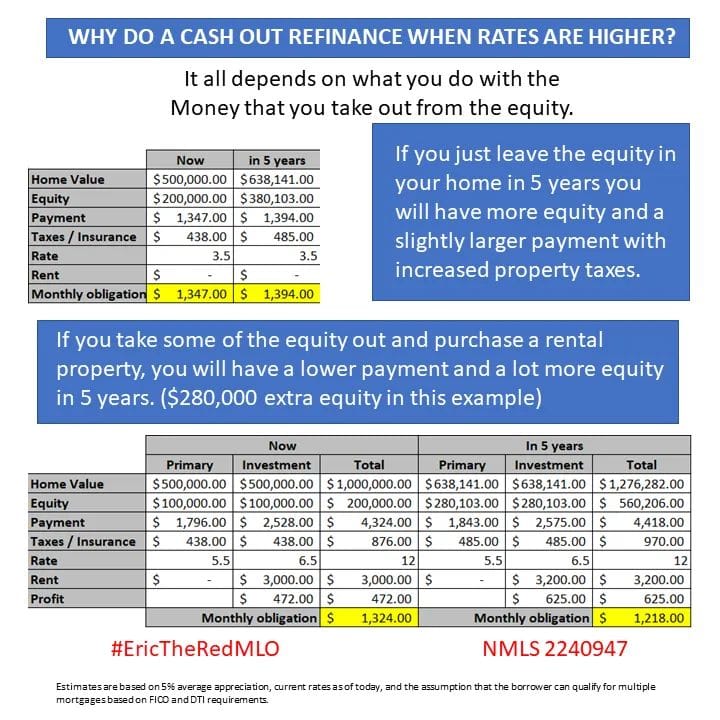

With a cash out refinance you would only take up to 80% of your equity out to avoid paying mortgage insurance but the rate is locked until the end of the loan or until you refinance again. This example uses a cash out refinance since that is most likely the best option in a rising rate environment like we have now. When you refinance the entire mortgage will have a higher rate than you probably have now, but in the long run it is a better financial option to build wealth more quickly. When rates drop again you can always refinance again to take advantage of the lower rates.

For example, suppose your home currently appraises for $500,000 and you owe $300,000 on your mortgage. A 80-percent cash out refinance will provide you credit equal to (0.8 x ($500,000 – $300,000)), or $100,000 to use as a down payment. This is the maximum amount you can draw without needing to pay mortgage insurance.

Use the Equity to Buy Another Property

Now with a $100,000 down payment you can purchase another single family home that is worth $500,000 and not have to pay mortgage insurance on that home. You can then rent out that home a a price higher than what you pay for it’s mortgage and the additional money can go to savings or to help pay the mortgage on your primary home.

In 5 years you will now benefit from the appreciation of both homes rather than just one and you will have around 50% more total equity. This is how investors leverage their assets to buy more more and build overall wealth. At this point you could refinance both properties and continue to build upon your real estate portfolio.

Im pretty pleased to find this great site. I need to to thank you for ones time for this particularly fantastic read!! I definitely loved every little bit of it and I have you saved as a favorite to see new stuff on your blog.