What is HECM for Purchase?

A Home Equity Conversion Mortgage (HECM) for Purchase is a reverse mortgage that allows seniors, age 62 or older, to purchase a new principal residence using loan proceeds from the reverse mortgage.

What’s different about HECM for Purchase versus a traditional mortgage?

• HECM for Purchase: Exclusively for home buyers age 62+.

• Traditional mortgage: No age restriction (except being legal age to enter a contract).

Repayment requirements

• HECM for Purchase: Flexible repayment feature — The borrower can choose to repay as much or as little as they like each month, or make no monthly principal and interest payments. The flexible repayment feature makes it easier for a buyer to afford the home they really want, preserve more savings and retirement assets, and improve cash flow. As with any mortgage, the borrower must keep current with property-related taxes, insurance and maintenance as part of their ongoing loan obligations. Repayment is generally required once they sell the home, pass away, move out or fail to meet their loan obligations.

• Traditional mortgage: Monthly principal and interest payment required. Builds equity as the loan is paid down.

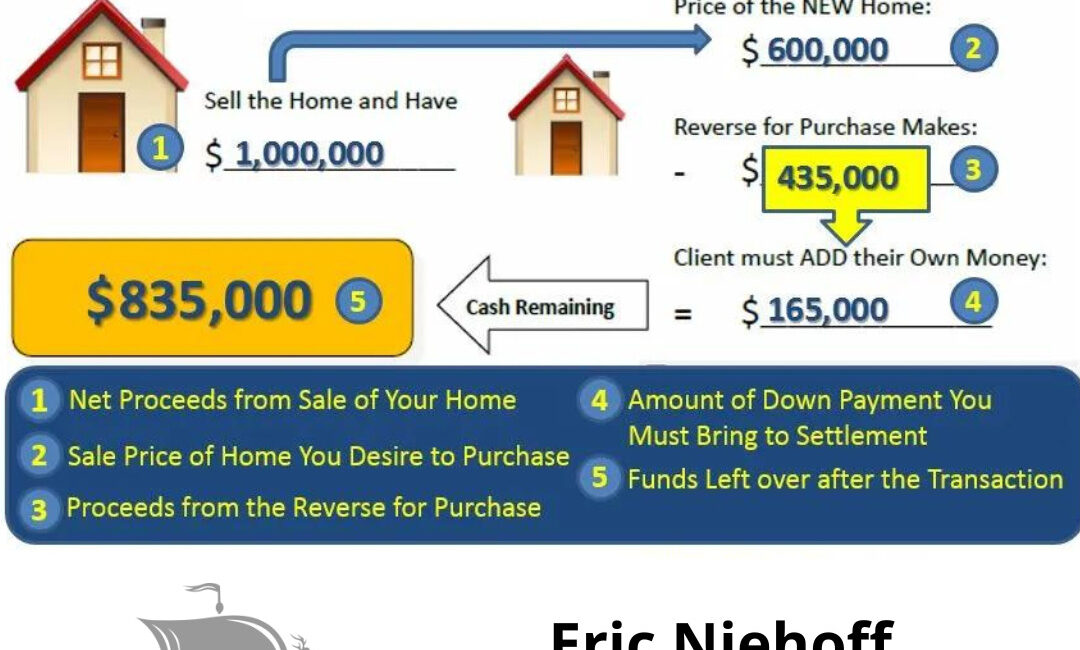

Down payment amount

• HECM for Purchase: Required down payment between approximately 45% and 62% of the purchase price, depending on buyer’s age or Eligible Non-Borrowing Spouse’s age, if applicable. (This range assumes closing costs will be financed.) The rest of the funds for purchase come from the HECM loan. This allows the buyers to keep more assets to use as they wish, as compared to paying all cash, while still having the flexibility of no required monthly mortgage payments.

• Traditional mortgage: Typically requires a smaller down payment.

Eligible properties

• HECM for Purchase: Single-family homes; FHA-approved condominiums; townhouses or Planned Unit Developments (PUDs); 2-to-4 unit homes that are owner-occupied; and manufactured homes meeting HUD guidelines.

• Traditional mortgage: Single-family homes; condominiums; townhouses or Planned Unit Developments (PUDs); 2-to-4 unit homes that are owner-occupied; manufactured housing; second homes; vacation homes; and investment properties.

Protection against owing more than home is worth

• HECM for Purchase: A Federal Housing Administration (FHA)-insured* program, HECM for Purchase has a non-recourse feature, which means the borrower can never owe more than the home is worth when the loan is repaid. The home is the only source of repayment regardless of the loan balance at maturity.

• Traditional mortgage: Most do not have a non-recourse feature. Since home values can decline, the borrower could owe more than the home is worth.