Your credit score follows you everywhere that you go affecting the most important of financial decisions. In a perfect world, we would all have great credit and have no barriers when making big purchases like buying a car or a new home. However, that isn’t the case for everyone. It isn’t the end of the world though. If a home purchase is in your future, you should start now in

Your credit score, also called a FICO score, is a simplified calculation of your history of paying back debts and making regular payments on loans. If you’re borrowing money to buy a home, lenders want to be assured that you’ll pay them back as agreed in the mortgage agreement. Your credit score and accompanying reports will be the primary basis for their decision.

Your credit score will determine whether you qualify for a mortgage, the amount of money you qualify for in a mortgage, and even the interest rate you receive. On a 30 year mortgage even a half a percentage difference in interest rate can mean paying tens of thousands more for your home. (Learn about the types of mortgages)

Pull Your Credit Report

There are three major U.S. credit bureaus (Experian, Equifax, and TransUnion), and each releases its own credit scores and reports. The scores will be similar on each report but there will be some variation.

You can get a free copy of your credit report every 12 months from each credit-reporting company from AnnualCreditReport.com. These reports do not include the actual credit scores just all of the information that each company has collected on you that they use to determine the score.

To get the actual scores there are several ways to access these.

- Many credit card companies offer a complimentary service that will tell you your score. It doesn’t usually show all three, but at least it can give you an idea. For example, Capital One has a service called CreditWise that will show you the scores from Experian and TransUnion.

- You can also access them directly from each of the credit bureaus though this many cost a small fee for each.

- CreditKarma.com is a free site that can be checked as many times as you want without affecting your score. Again it only shows you 2 of the credit bureaus and only a brief summary of what is on your report, but it is still a good monitoring tool as you work to fix your credit.

Links to the credit bureaus: TransUnion — Experian — Equifax

Evaluate Your Credit Score

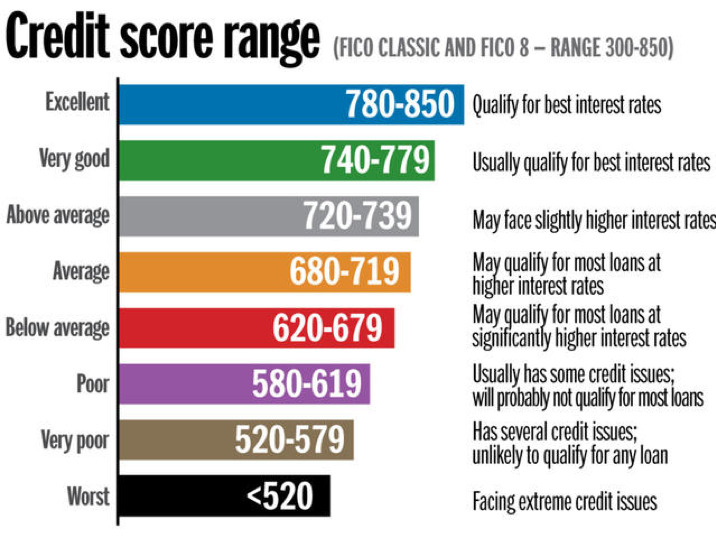

Credit scores range from 300 to 850. The higher your score, the better the offers will be from lenders. The Federal Housing Administration requires a minimum credit score of 580 to permit a 3.5% down payment, and major lenders often require at least 620, if not more. The best offers from lenders will go to borrowers with a 750 score or higher.

Where do you stand?

- Excellent Credit: 750+

- Good Credit: 700-749

- Fair Credit: 650-699

- Poor Credit: 600-649

- Bad Credit: below 600

If your credit score is not within the excellent or at least the good credit range, it’s time to find a way to fix it.

Dispute Any Errors

Look over your credit report. Are there any obvious errors? Is an account showing a balance that you have actually paid off? Is there an account that is not yours? Does a creditor show a late payment that is wrong?

Each credit bureau has a way to dispute these marks. Typically there is an online form that you can fill out. If you have documentation that backs up your claim you will be even better off when disputing it.

Erase Late Payments

If you missed just a payment or two, most companies will tell their reporting division to remove this from your credit report if you just ask. This only works if you have a history of on time payments outside of the one or two accidents. Late payments will definitely affect your score so having as few of these as possible is a must.

Increase Your Limits

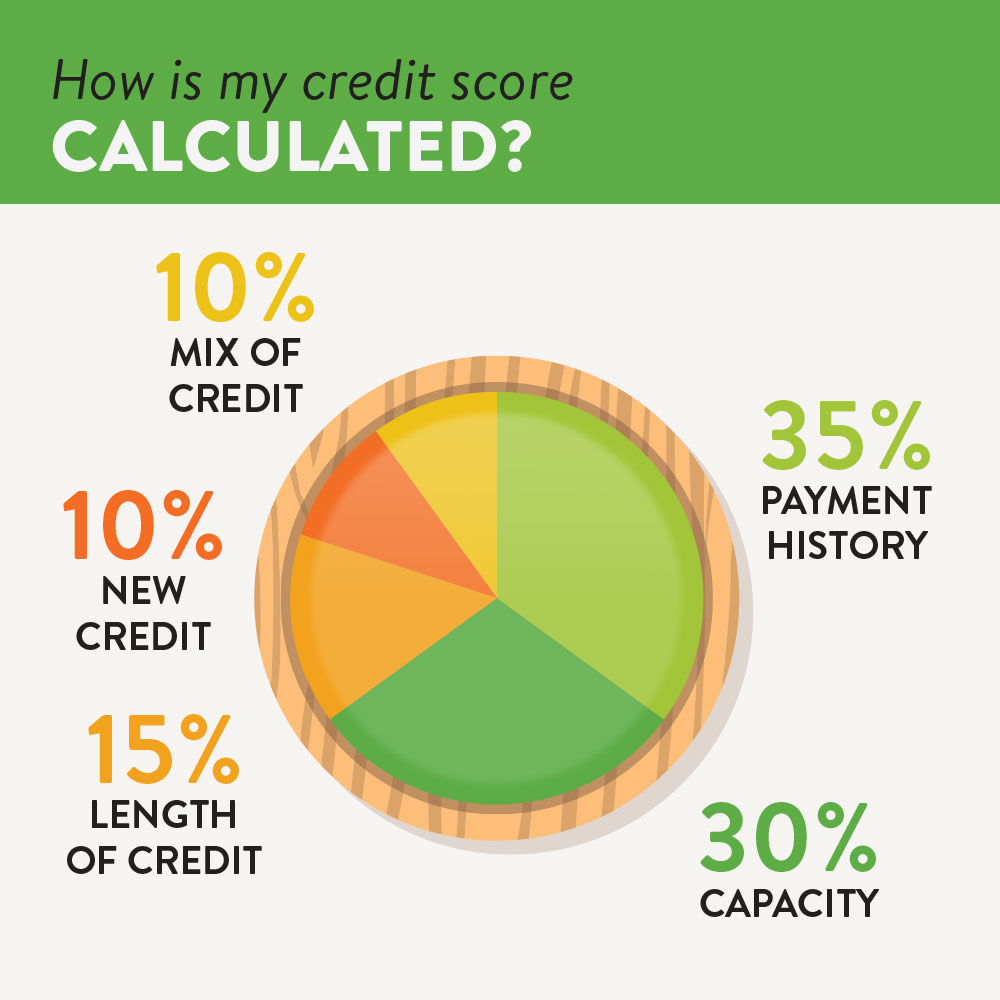

One of the biggest factors in your credit score is the credit usage percentage. If you have $1,000 in credit card debt on a $1,500 limit that means your usage percentage is 67%. If you have been consistently paying on time you may be able to contact your credit card company and ask for an increase in the limit. You will have even more success in this if you have had and positive changes in your financial situation. Maybe you had a promotion or a raise at work. If you were able to raise the limit to say $5,000, your usage percentage would now be only 20%. For the best credit scores you want to keep your usage percentage under 15%.

Pay Down Credit Debt

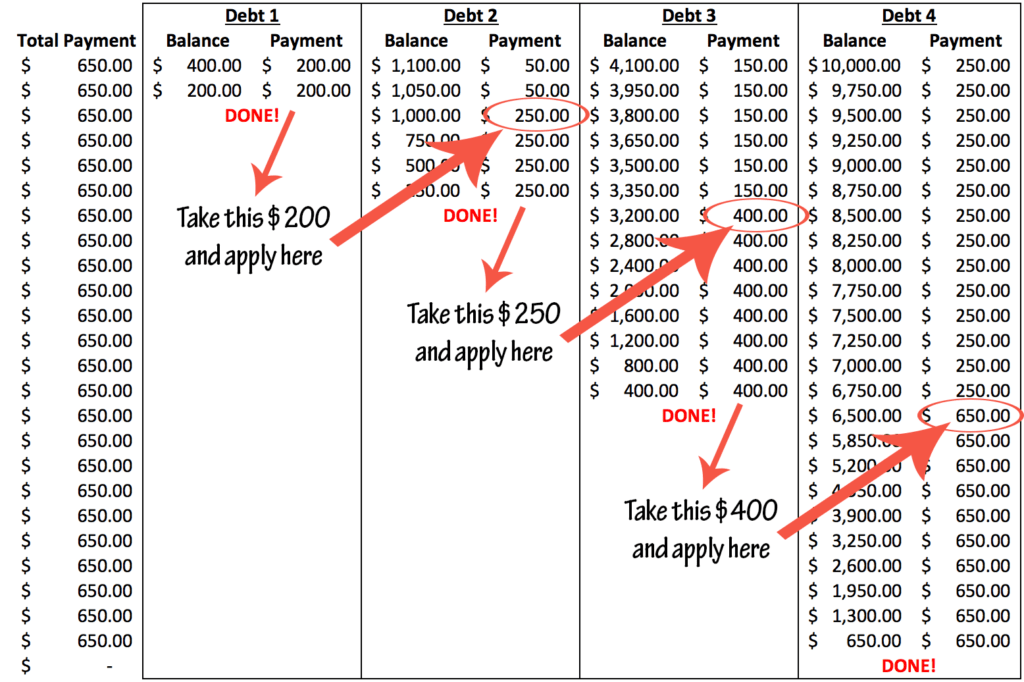

If you are unable to increase your credit limits, you will have to pay down the credit balances to reach that optimal 15% credit usage. The best way to do this is to write a monthly budget and find out what you can afford to put toward your debts. Then set up a snowball debt payoff plan. This is accomplished by taking the monthly payment you can afford and focusing the portion that is above the monthly minimums to one debt. Once that debt is paid off you continue to pay the same total but refocus the amount to the next debt.

There are two ways that you can approach this. You can either pay off the debt that has the highest interest rate first or you can pay off the smallest balances first. You should write a spreadsheet to see which way will get you out of debt faster. As your debts get paid off you credit score will increase.

Below is a simplified example that does not take into account interest.

Pay On Time

If you aren’t already paying on time with your financial obligations, start now. Payment history accounts for about 35% of your credit score. The longer period of time you have with on time payments, the higher your score.

Collections

You’ve checked your report and you saw that there are one or two delinquent accounts. If an account goes unpaid for 60-90 days it is often sent to a collection company. These accounts will bring your score down quite a bit. If you see accounts like this on your credit report get them handled as soon as possible.

Here is what you should do:

- Contact the collection agency.

- Find out the exact amount that you owe.

- See if they will accept a settlement amount. Often times this can be a lower amount than the total if you pay all in one payment.

- If you can’t pay all at once, set up a payment plan.

- Whether you pay all at once or through a payment plan ask the collection company if they will remove the mark on your credit history once it is paid. If they agree (most companies will) get it in writing. You can use that letter as documentation later to dispute the mark on your credit report if the collection company doesn’t remove it.

Negative accounts like this can remain on your credit report for up to seven years.

Length of Credit History

Another factor in determining your credit scores is the length of your credit history. You can’t change this too much, but you can control how many new accounts are opened. If you are looking to make a large credit purchase like a new home, it isn’t the best time to get new credit cards, apply for new loans, or buy a new car. Opening too many new accounts will make lenders more wary of offering you a mortgage and will bring down the average age of your credit accounts.

Credit Scores Don’t Change Overnight

It usually takes 30 days for credit bureaus to reflect any changes. If you pay off an account, increase your credit line, or get an item disputed, it won’t show up right away. This is why you want to fix your credit long before making any large purchases.